Analyze profitability regularly to ensure that the profit center generates sufficient revenue to cover costs and contribute to the organization’s bottom line. The impact of cost and profit centers on the balance sheet and cash flow statement can also differ. Cost centers typically do not significantly impact the balance sheet, as they do not generate assets or liabilities. On the other hand, profit centers may create assets such as inventory and accounts receivable and liabilities such as accounts payable and debt. After a few years, Peter Drucker corrected himself by saying that there are no profit centers in business, and that was his biggest mistake.

Difference between cost center and profit center

This concept was about the difference between a cost centre and a profit centre. Stay tuned for questions papers, sample papers, syllabus, and relevant notifications on our website. This article is a ready reckoner for all the students to learn the difference between a cost centre and a profit centre. And to calculate the cost of production of the respective cost centre, all the costs related to that particular activity would be accumulated separately. In conclusion, the seamless coordination and operation of Profit Centers and Cost Centers ensure that business run smoothly and at scale.

Profit centres

These mechanisms involve a range of strategies and tools designed to monitor and reduce expenses without compromising service quality. One common approach is the use of variance analysis, which compares actual expenses to budgeted amounts, identifying discrepancies that need to be addressed. Forecasting, on the other hand, involves predicting future financial conditions based on historical data and market trends. This allows cost centers to anticipate potential challenges and opportunities, enabling proactive management. For example, a human resources department might forecast future hiring needs based on projected company growth, allowing them to allocate resources for recruitment and training effectively. We’ve now covered the differences between cost centers and profit centers, but there’s a third type of division that you might come across.

Cost Centers – Examples of Companies Operating as Cost Centers and Profit Centers

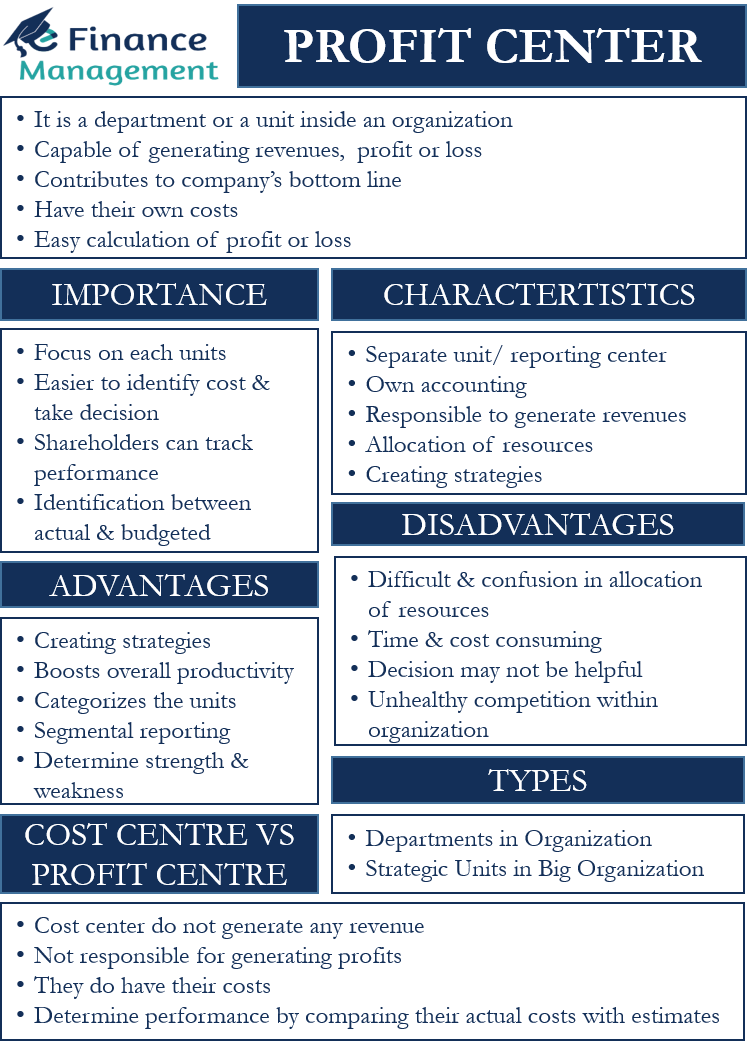

Cost centers are responsible for managing and controlling costs within an organization. They do not generate revenue directly but are critical for operating expenses and improving profitability. Some examples of cost centers include accounting, human resources, and IT departments. The distinction between profit centers and cost centers lies at the heart of organizational structure and financial management. Profit centers are business units or departments within a company that are directly responsible for generating revenue. They have their own income statements and are evaluated based on their ability to produce profits.

While both cost centers and profit centers work have the same goal of furthering a company’s growth, there are some key differences to be aware of. A profit center is a unit of a business that is responsible for generating revenue for the business. A profit center utilizes business resources to generate revenue and thus has both identifiable revenues and identifiable costs. These departments are essential to the overall operations of a company, but they don’t directly generate profit. Instead, they generate and manage the costs that keep the business running smoothly.

By analyzing cost center data, organizations can make informed decisions regarding resource allocation, process improvements, and cost-saving initiatives. Management’s primary responsibility in profit centers is to generate revenue and increase profits. They are responsible for developing and implementing strategies to achieve business objectives, such as increasing sales and 4 steps to freelance full market share, improving customer satisfaction, and optimizing pricing. Cost centers typically have limited decision-making authority, as their primary role is to cost-effectively provide support and services to other parts of the organization. Cost centers are responsible for managing expenses and keeping costs within budget while providing necessary support and services.

Positive cash flow indicates that a profit center is generating enough cash to sustain its operations and invest in growth opportunities. This metric is vital for understanding the liquidity and financial stability of the profit center. For instance, a profit center with strong cash flow can easily fund new projects, pay off debts, and navigate economic downturns, thereby ensuring long-term sustainability.

- When setting a budget for a cost centre, it is normal to specify how long it should take to produce each item (standard hours/unit) and how many hours the factory is expected to work.

- Implement cost-saving measures to ensure that the cost center operates efficiently.

- To optimize profits, management may decide to allocate more resources to highly profitable areas while reducing allocations to less profitable or loss-inducing units.

- In conclusion, cost and profit centers are distinct business units with unique characteristics, advantages, and disadvantages.

The centres where the firm undertakes production or conversion activities is production cost centres. Here transformation of raw material into such products which are ready for sales takes place. Think of a situation when the whole factory is treated as a single unit for both budgeting and cost control purposes.

As a company grows, it’s important to join together all of these various units with a central accounting system. GoCardless integrates with over 350 partners, including leading software including Chargebee, Salesforce, and Xero, to keep your workflow organized across multiple locations and branches. It can include using automated systems, software, and other tools to reduce manual work and increase accuracy.

To reduce its costs and drive up profits what the cost center must do is work towards greater operational efficiency. For example, optimizing customer service solutions empowers retention and increases product value, which in turn translates to bolstered brand reputation and ultimately higher sales. It is standard business practice to distinguish between profit- and cost-generating units.